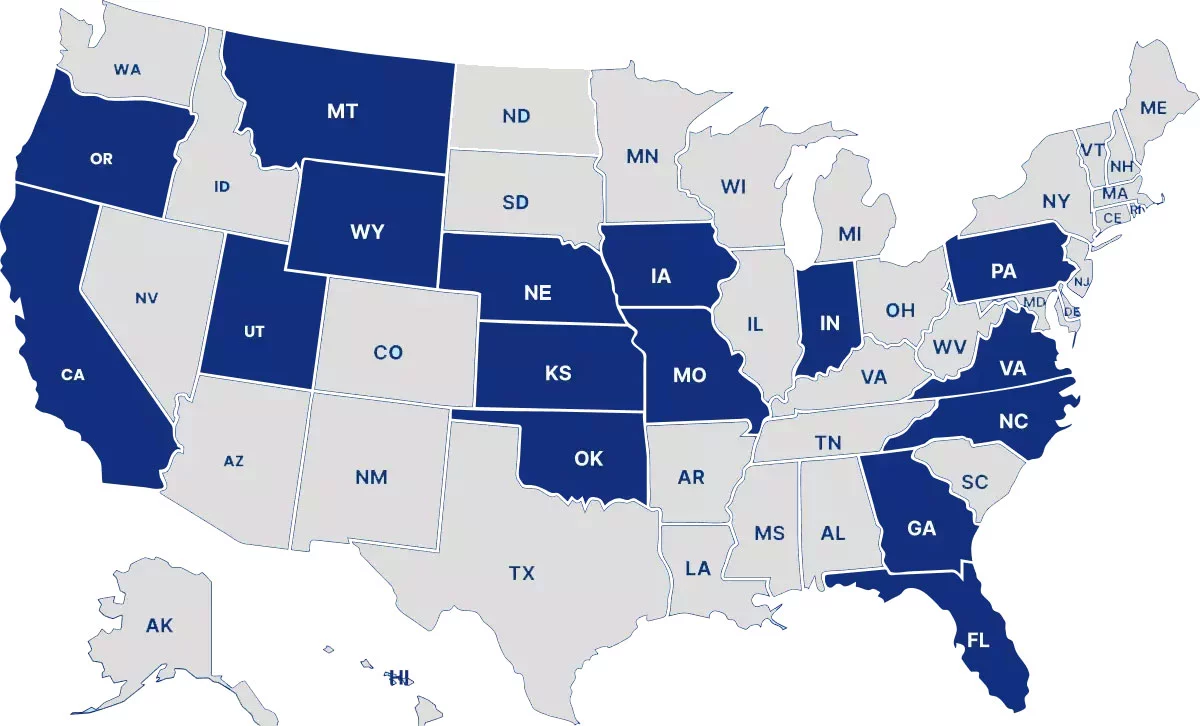

Map Portpofolio

Casa Del Sol

Casa Del Sol consists of 10 two-story multifamily apartment buildings located in Calipatria, CA, just 25 miles north of El Centro. The community contains 41 two-bedroom, two bath apartments and 40 three-bedroom, two bath apartments. Casa Del Sol provides affordable housing to families earning no more than 30%, 40%, 50%, and 60% of Imperial County AMI (area median income).

Read More

Read More

Sierra Vista

Sierra Vista consists of 6 two-story multifamily apartment buildings located in Seeley, CA, just 10 miles west of El Centro. The community contains 24 two-bedroom, two bath apartments and 24 three-bedroom, two bath apartments. Sierra Vista provides affordable housing to families earning no more than 30%, 40%, 50%, and 60% of Imperial County AMI (area median

Read More

Read More

New Yorker Apartments

The New Yorker Apartments is comprised of one three-story building located in the historic district of Downtown Bakersfield. This midrise community features a unique unit mix of studio, one, and two bedroom apartments all of which have been thoughtfully restored to maintain their authentic vintage ambiance. Common area amenities include on site laundry facility, off street parking, and a beautifully landscaped courtyard appointed with a koi pond.

Read More

Read More

The Reserve at 5th

Located four miles east of Eugene, the city of Springfield has experienced a housing shortage in recent years and has an average vacancy rate of just 2% as a result. McKee Private Capital identified this asset as a replacement property for a 1031 exchange and successfully closed the transaction in December, 2017, marking its first acquisition in the state of Oregon. We obtained financing through Freddie Mac’s small balance loan program. In addition to monthly cash distributions, investors can expect steady appreciation in asset value given the underlying fundamentals in this growing market.

Read More

Read More

Pioneer TownHomes

Pioneer Townhomes is a newly constructed (2019) apartment community located in the Eugene-Springfield MSA just four miles east of the University of Oregon. Springfield is located along the interstate 5 highway, connecting the region to other large metro areas. Diverse economic drivers include healthcare, education, and a growing tech industry.

Read More

Read More

Autumn Run

Autumn Run is comprised of ten, two-story multifamily apartment buildings. The community features a well- balanced mix of one, two and three-bedroom apartments totaling approximately 99,000 rentable square feet. Autumn Run provides affordable housing to families earning no more than 60% of Cascade County’s AMI (area median income). Ownership must lease to renters within this prescribed income cap.

Read More

Read More

Capital Greens Apartments

Capital Greens Apartments consists of 12 two-story apartment buildings situated on a 5.52-acre parcel located in Cheyenne, Wyoming.

Read More

Read More

River Run Apartments

River Run Apartments I & II is a 64-unit affordable housing community located in Laramie, WY. The property is located minutes from schools, shopping, Interstate 80, and the University of Wyoming.

Read More

Read More

Sierra Pointe

Sierra Pointe consists of 15 two-story apartment buildings situated on two parcels totaling approximately 11 acres in St. George, UT. Just 40 miles west of Zion National Park, this garden style community features an attractive unit mix of studio, one, two, and three bedroom apartments. Common area amenities include on site laundry facilities, community fitness center, playground, sauna, and garage parking.

Read More

Read More

Woodwinds

Woodwinds Apartments consist of 6 two-story multifamily apartment buildings located in

Norfolk, Nebraska. The buildings contain a total of 44 two-bedroom and 6 three-bedroom apartment townhomes all of which are made affordable to our residents with rental assistance provided under a HAP Contract (Housing Assistance Payments), administered by the U.S. Department of Housing and Urban Development. Amenities include an onsite laundry facility, playground, and central air conditioning.

Read More

Norfolk, Nebraska. The buildings contain a total of 44 two-bedroom and 6 three-bedroom apartment townhomes all of which are made affordable to our residents with rental assistance provided under a HAP Contract (Housing Assistance Payments), administered by the U.S. Department of Housing and Urban Development. Amenities include an onsite laundry facility, playground, and central air conditioning.

Read More

Riverfront

Riverfront consists of 3 three-story multifamily apartment buildings located in South Sioux City, Nebraska, just across the Missouri River from Iowa. The community contains one, two, and three-bedroom apartments and caters to low income households earning no more than 60% of Dakota County’s AMI (area median income). Community amenities include onsite laundry facilities in each building, laundry hook-ups, garages for rent, and a playground.

Read More

Read More

Sunrise Gardens

Lincoln is the capital of Nebraska and the second most populous city in the state, home to 285,000 people. While government and higher education rank as top employers, other prominent industries include finance, insurance, manufacturing, pharmaceutical, telecommunications, and railroad.

Read More

Read More

Charles Schwab

6,760 SF of office space occupied by tenant Charles Schwab Investment Co., Inc (S&P: A+). Built in 2014, this asset is located in Overland Park, KS, the largest suburb of Kansas City. This prime location boasts daily traffic counts of 50,000 vehicles per day with average household incomes exceeding $140K within a 3 mile radius of the property.

Read More

Read More

White Lakes Plaza

White Lakes Plaza consists of 9 two-story buildings located in suburban southwest Topeka. This garden style community offers an attractive unit mix of 72 one-bedroom and 72 two-bedroom apartments. Common area amenities include our resort style swimming pool, community clubhouse, on site laundry facility, and covered parking.

Read More

Read More

Governor’s Court

Lincoln is the capital of Nebraska and the second most populous city in the state, home to 285,000 people. While government and higher education rank as top employers, other prominent industries include finance, insurance, manufacturing, pharmaceutical, telecommunications, and railroad.

Read More

Read More

Carriage House

Carriage House consists of 12 two and one-half-story buildings situated on 9 acres in southwest Topeka, Kansas. This garden style community features one and two bedroom apartment homes. Common area amenities include two swimming pools, a community clubhouse, on site laundry facilities in each building, and abundant off street parking. Beautifully landscaped courtyards provide residents with a serene setting within the capital city of Kansas.

Read More

Read More

Eastbrook Apartments

Cushing, OK is located 70 miles northeast of Oklahoma City and just 20 miles east of Stillwater, which is home to the main campus of Oklahoma State University. Apartment vacancy rates in this submarket are sub 5% as a result of low apartment housing inventory and limited supply in the pipeline. Additionally, Cushing is one of the largest oil storage locations in the country.

Read More

Read More

Prime Square Apartments

Prime Square was placed into service in 2008, and is comprised of 50-1 Bedroom and 30-2 Bedroom units, plus 2,400 SF of commercial ground floor office, currently occupied by the Iowa Visiting Nurse Health Services. The senior resident profile is comprised of a majority of long-term residents, with an annual turnover rate of just 18%, resulting in low operating costs. Community amenities include a beauty salon, two elevators, library, computer center, covered off-street parking and common area dining room.

Read More

Read More

Northeast View

Northeast Apartments is a government subsidized apartment community located in the historic Pendleton Heights district of Kansas City. The property is comprised of 12 two and one-half-story buildings which collectively offer an attractive unit mix of 10 one-bedroom, 76 two-bedroom, and 51 three-bedroom apartments. Community amenities include onsite laundry, off street parking, and central air conditioning.

Read More

Read More

Englewood

Englewood Apartments is a government subsidized apartment community situated just north of the Missouri River in Kansas City. The property features a diverse unit mix which includes one-bedroom, two-bedroom, three-bedroom, and four-bedroom apartments. Community amenities include playground, onsite laundry, off street parking, and central air conditioning.

Read More

Read More

Park Madison

Situated just 15 minutes south of Indianapolis, Park Madison Apartments is comprised of 7 two-story multifamily apartment buildings located on approximately three acres of land. The community consists of 56 two-bedroom floor plans totaling 64,400 rentable square feet for a generous 1,150 square feet of living space per apartment.

Read More

Read More

Oakshire Senior Apartments

Oakshire Senior Apartments consists of 1 three-story apartment building situated on a parcel totaling approximately 2.9 acres in Reading, PA. Reading is centrally located in southeast Pennsylvania, within 60 miles of major metropolises such as Philadelphia, Lancaster, and Harrisburg.

Read More

Read More

The Oaks Apartments

Lincolnton, NC is a bedroom community located 37 miles northeast of Charlotte, and part of the Charlotte MSA.

Located between the Blue Ridge Mountains and coastal plains, the Charlotte metro stretches 3,198 square miles across the Piedmont region of the Southeastern United States. It contains seven counties in North Carolina: Mecklenburg, Gaston, Union, Cabarrus, Iredell, Rowan and Lincoln. South Carolina counties include York, Lancaster and Chester. A strong financial presence has contributed to the local population growing to more than 2.4 million citizens, becoming one of the nation’s fastest growing metros over the past 15 years.

Read More

Northside Gardens

Northside Gardens is a market rate, multifamily apartment community located in Warner Robins, GA. This property contains 32 single-story buildings which feature one-bedroom, two-bedroom, and three-bedroom floor plans. The 18 acre site is abundant with indigenous pine trees creating a peaceful, campus-like atmosphere for residents. Community amenities include two swimming pools, a laundry facility, a community clubhouse, and two tennis courts.

Read More

Read More

Lehigh Acres

16 single family homes, built between 2005-2006 in Lehigh Acres, FL, east of Ft. Myers, and just 20 minutes from the Gulf of Mexico. Homes range in size from 3BR/2BA to 4BR/2.5BA and are situated on ¼ acre lots. Features include upgraded appliances, laundry rooms, tile floors, large screened lanais and two car garages.

Read More

Read More